on Posted on Reading Time: 4 minutes

Here’s a story that should sound familiar to many readers of this blog:

The enterprise WAN has undergone a major shift in the past few years, due to digital transformation, the shift to cloud and XaaS for data and applications, the increasing availability of lower cost but reliable internet access for local breakouts, and the ability to manage and orchestrate networks through an SD-WAN overlay.

No matter how well telecom industry insiders know this story, however, it is crucial to stay on top of how the narrative is actually playing out for corporate IT infrastructure teams and provider revenues. In other words, how does the work the industry is doing at MEF relate to on-the-ground enterprise network deployments and WAN revenues?

Before we can talk about revenue, though, we have to look at demand.

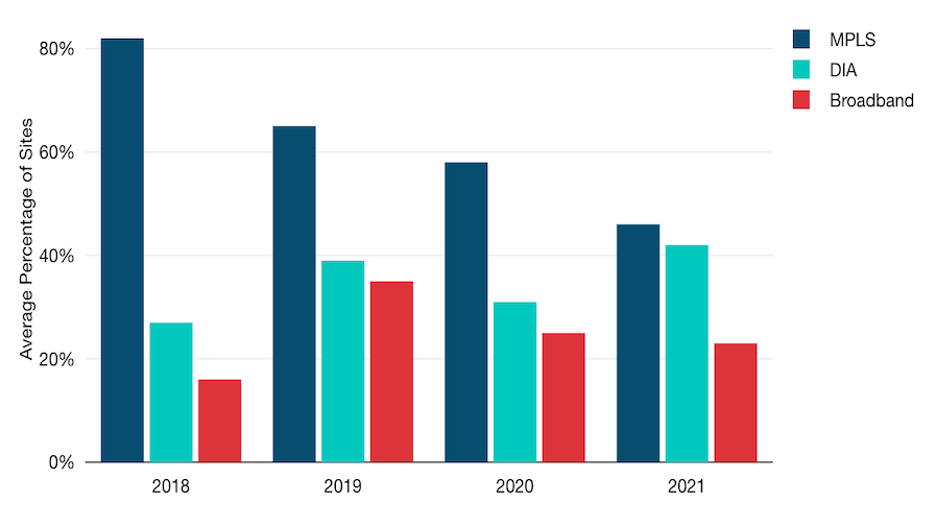

Since 2018, TeleGeography has conducted an annual survey of WAN managers from (mostly) large multinational enterprises. Over the past five years of surveys, we have seen MPLS fall from an average of 82% of sites in the typical network in 2018 to fewer than half in preliminary results from our 2022 update. (Data collection and analysis from the latter is still underway as of this writing.) At the same time, DIA has grown from 27% of sites in the average network in 2018 to 47% so far in 2022.

What is the average product mix of your WAN sites? (Change, 2018-21)

Notes: Each bar represents the average percentage of WAN sites using the listed products across all respondents in each listed year. Chart does not show data cited in the text from the 2022 survey which is still underway. Source: TeleGeography, © 2022 TeleGeography

Another familiar story? The pandemic-driven shift to bandwidth-hungry UC tools like Teams and Zoom–among other drivers–has boosted bandwidth demand.

In 2018, survey respondents reported an average of 17% of sites with DIA connections larger than 100 Mbps. By 2022, our preliminary data indicates that nearly half of DIA ports are that large.

Also underway before COVID but pushed along by pandemic-driven workplace changes was the move to the cloud. Our 2019 survey focused on cloud strategy and indicated that a strong majority of enterprises–around 70%–had some mix of on-prem and off-prem data centers. Our 2022 update of these cloud trends showed a similar trend with three out of four respondents so far indicating a similar mix.

Finally, we have perhaps the key story in all of this. While SD-WAN was well-positioned to take over before COVID, hybrid work and cloud adoption have only accelerated that trend. In 2018, only 18% of enterprises we surveyed had already installed SD-WAN. By 2020, that was up to 43%. Our preliminary 2022 data demonstrates that more than half of respondents have already rolled out SD-WAN and around a quarter are currently in the process of doing so.

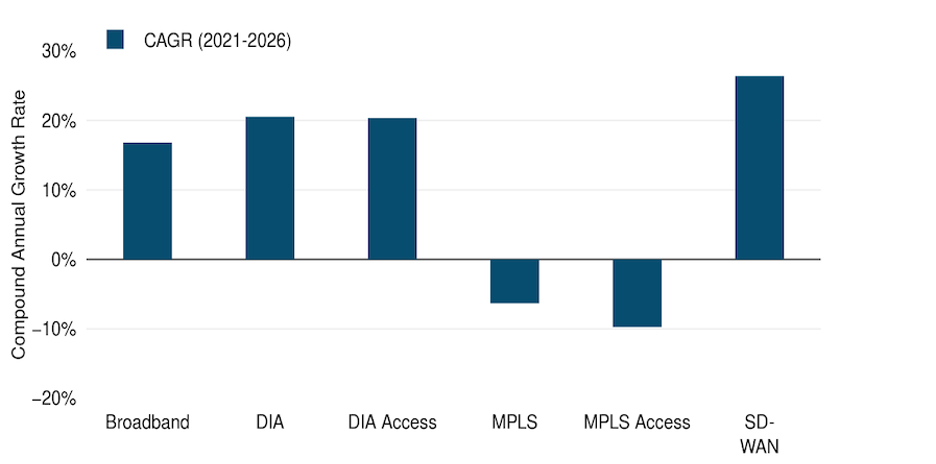

To relate these trends to revenue, we built a model that takes our 2021 demand side data and our WAN pricing data to calculate WAN revenues for connecting the largest 5,000 companies in the world. Our model includes revenues broken out by MPLS and DIA ports, MPLS and DIA access circuits, business broadband circuits, and SD-WAN overlay charges. We then forecasted those revenues forward five years based on how we see demand developing.

In short, we think MPLS will stick around, but will be deployed at fewer sites and experience little, if any, bandwidth growth due to its higher costs. Instead, DIA, and to a lesser extent, business broadband, will be the products enterprises choose to meet growing bandwidth needs. SD-WAN will be a widely popular–if not quite ubiquitous–overlay service.

Our model forecasts that WAN revenue will grow significantly over the next five years. The global revenue for the largest 5,000 corporate networks–$59 billion in our 2021 median model run–goes up to $85 billion by 2026.

While MPLS and MPLS access revenue contracts over this five-year period, this is easily supplanted by the growth in DIA, especially as bandwidth demand increases along with the shift to Internet. Our model shows DIA as a $16 billion business in 2021, but more than $40 billion by 2026.

SD-WAN charges produce less absolute revenue but show the strongest growth in the model. The SD-WAN market grew 26% in our model–from $3 billion in 2021 to nearly $10 billion by 2026.

Global Five Year CAGR for WAN Products: 2021-2026

Notes: Each bar represents the compound annual growth rate for the WAN revenue of the listed product in the median model run from 2021 through 2026. Source: TeleGeography, © 2022 TeleGeography

Growth in the WAN space certainly looks like it will be focused on Internet and SD-WAN in the coming years, at the expense of traditional WAN services like MPLS. And enterprises want a standardized service.

We asked respondents how important it was that their SD-WAN service is certified by a standards body such as MEF, and 70% indicated it was “important” to “extremely important.” We also asked a question about uptake of NaaS services for the first time in 2022. Thus far, we have found that very few enterprises have already adopted these services, but many are familiar and interested in researching them for the future. This indicates a significant need for automation of network provisioning as enterprises seek to move toward flexible and on-demand services.

Here’s the upshot. According to our demand data and forecast model, MEF efforts such as MEF 70.1 for SD-WAN and MEF 3.0 service automation standards for IP are well-aligned with the likely direction WAN revenue will take over the next several years.

Enterprises must shift away from a static, lower bandwidth, MPLS-centered network with central breakouts, to a flexible, hybrid, and higher bandwidth WAN. It is crucial that providers embrace these changes and develop flexible, automated, Internet-first solutions that can meet enterprise business needs.

TeleGeography is a telecommunications market research and consulting firm that conducts in-depth research, compiles large data sets, and presents this information in easy-to-use online reports and databases. Their primary research areas include enterprise MPLS VPN, Ethernet, dedicated internet access, and international private line service providers and pricing.

Learn More

Learn more about MEF’s work in SD-WAN.